Understanding Machine Learning for Diversified Portfolio Construction by Explainable AI

Abstract

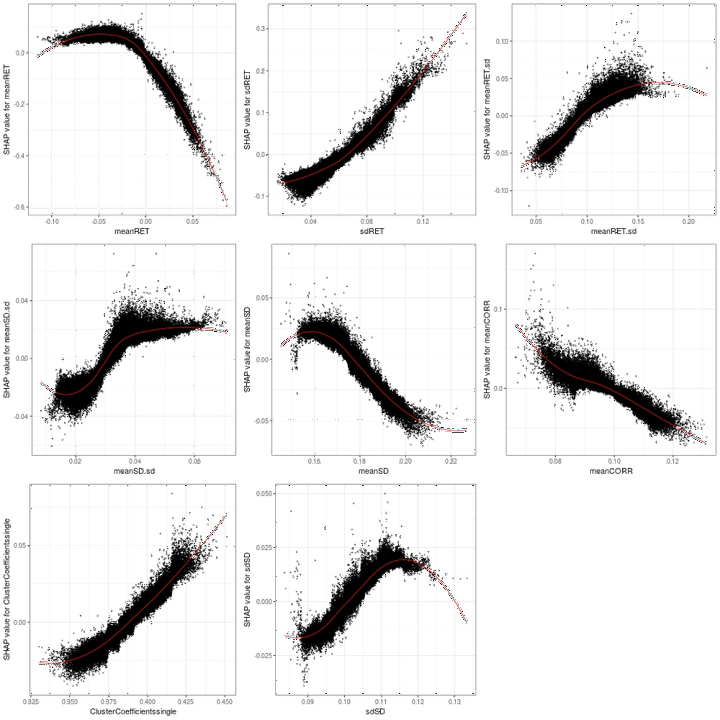

In this paper, we construct a pipeline to investigate heuristic diversification strategies in asset allocation. We use machine learning concepts (“explainable AI”) to compare the robustness of different strategies and back out implicit rules for decision making. In a first step, we augment the asset universe (the empirical dataset) with a range of scenarios generated with a block bootstrap from the empirical dataset. Second, we backtest the candidate strategies over a long period of time, checking their performance variability. Third, we use XGBoost as a regression model to connect the difference between the measured performances between two strategies to a pool of statistical features of the portfolio universe tailored to the investigated strategy. Finally, we employ the concept of Shapley values to extract the relationships that the model could identify between the portfolio characteristics and the statistical properties of the asset universe. We test this pipeline for studying risk-parity strategies with a volatility target, and in particular, comparing the machine learning-driven Hierarchical Risk Parity (HRP) to the classical Equal Risk Contribution (ERC) strategy. In the augmented dataset built from a multi-asset investment universe of commodities, equities and fixed income futures, we find that HRP better matches the volatility target, and shows better risk-adjusted performances. Finally, we train XGBoost to learn the difference between the realized Calmar ratios of HRP and ERC and extract explanations. The explanations provide fruitful ex-post indications of the connection between the statistical properties of the universe and the strategy performance in the training set. For example, the model confirms that features addressing the hierarchical properties of the universe are connected to the relative performance of HRP respect to ERC.